What Money Overwhelm Really Feels Like

It’s not always a crisis that makes us pause, a quiet nudge about the future can be just as potent.

A daily drip of questions with decision fatigue making it all the more difficult so your answers are “I don’t know” on repeat.

In this 3rd & final chapter of the Disorganised Darcy Diaries, Darcy discovers that calm doesn’t come from having all the answers but from knowing what her next step is.

She was sat at the kitchen table one late afternoon Christmas cards half-written, when she opened her banking app to check something small. Not because she was worried, just because she’d started doing that now. Checking in. Staying present.

That’s when she saw it. An email notification popped up, her mortgage deal was ending in three months.

The number beside it made her blink.

Not catastrophic. But enough to change things. An extra £268 a month for her new mortgage rate would make life more of a challenge. Although she didn’t know exactly what that would mean for her family budget.

Old Darcy would have shut the app immediately. She’d have told herself she’d deal with it after Christmas. Or in the New Year. Or when life felt a bit calmer.

Looking Back Without Blame

She realised this wasn’t just about the mortgage. It was about how she’d been living for years. Reacting, firefighting, hoping things would somehow stay the same if she didn’t poke them too hard.

She thought about how money had always felt like something that happened to her.

Rates changed. Bills went up. Life shifted.

And she adjusted… sort of. Enough to get by. Enough to cope.

But never enough to feel ahead. This wasn’t failure.

It was simply the past playing out without a plan. And it would continue to do so unless she made a change.

Standing in the Present, Clear-Eyed

Darcy opened her notebook, yes an actual paper notebook.

She wrote three headings: Now, Next, Later

Under Now, she wrote what she actually knew. Not guesses, not her fears. Just facts.

- When the mortgage deal was ending

- What her current payments were

- What she roughly spent each month

- What she’d already improved since starting to pay attention

Under Next, she wrote questions. Not decisions, not yet.

- What options might I have?

- What would feel manageable?

- What would I want to protect?

And under Later, something unexpected happened.

She paused.

Because this was the part she’d never allowed herself before. Most of her plans had gone awry over the years so thinking ahead had become a waste of time.

She pictured herself six months from now.

Not suddenly wealthy, not perfectly organised.

Just… steadier.

Someone who:

- knew what was coming before it arrived, as best as ever you can.

- wasn’t emotionally derailed by changes

- trusted herself to respond calmly

- had space to enjoy Christmas, birthdays and holidays without a quiet dread humming underneath

She felt something, not excitement exactly, but maybe it was relief. And with it, a realisation.

This wasn’t about a spreadsheet, having more willpower or being “better with money”.

This was about having a process. A way of thinking. A restoration of her values. A rhythm that carried her through change instead of knocking her sideways.

A way of co-creating her life instead of it dragging her along for a ride.

She could do some of this alone, she had already begun.

But she could also see the gaps. The places where she’d hesitate. The moments where she’d want someone to say, “Let’s look at this together.”

How Gentle Financial Planning Creates Calm

That evening, as the Christmas lights flickered on in the window, Darcy felt something settle.

She didn’t need to fix everything before the end of the year. She didn’t need all the answers right now.

But she did need a plan. She had enjoyed creating a few ideas, she felt inspired by her thoughts of what life could look like by the summer. She loved the creative process of writing in her notebook.

For the first time in years, her thinking evolved from planning was restrictive & pointless to it was protective of her time, money & mental wellbeing.

And as she closed her notebook, she thought:

Next year doesn’t have to feel like the last one.

A Kinder Way to Manage Everyday Finances

Let me be your guide to reducing your money overwhelm:

If you’re

- ready to stop reacting all the time and start planning intentionally

- craving a clear process, emotional support, and practical structure so it’s not adding to your mental clutter

- wanting to learn how to navigate changes like mortgage renewals, so that they’re far less overwhelming & far less expensive

💫 You’re ready for your fairy godmother – and you can go to the ball my dear… 💫

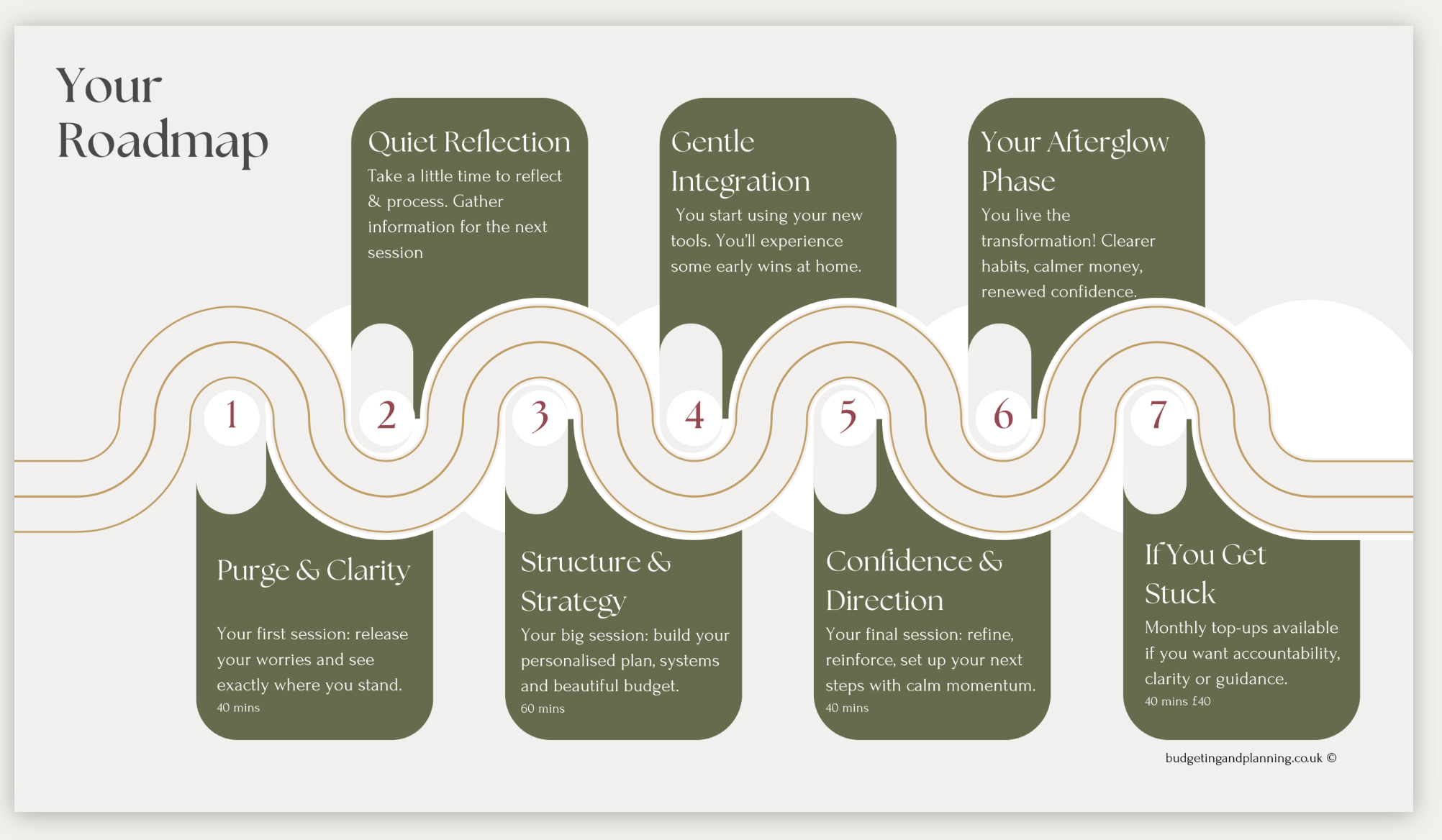

Your Fairy Godmother Experience Roadmap, Your Waitlist & Other Goodies

Have yourself, a merry little Christmas and maybe treat yourself to an eGuide:

When You’ve Lost Your Way with Money: A Reset Workbook

A gentle workbook to reset your finances when life’s got messy. Reflect, plan, and take calm, step-by-step action. Perfect for midlife and beyond.

ps If you’d like to follow along in almost daily conversations, please come and find me on Linkedin:

0 Comments